As the cost of living continues to rise due to inflation and interest rates, employers are seeking innovative ways to support their employees’ financial wellness. Amazon and Delta are among the companies that have developed financial wellness programs to aid their employees. Payroll Integrations, a startup based in San Diego, is one such company that offers payroll integrations with benefits automation as an integration platform-as-a-service (iPaaS).

The Founding Story of Payroll Integrations

Founded in 2016 by Doug Sabella and Andrew Hallengren, Payroll Integrations was created to address the lack of automation in the benefits space. Hallengren, a registered investment advisor, recognized the need for a more efficient way to manage employee benefits. He teamed up with his friend Sabella, who was working at Salesforce at the time, to develop a solution. Through continued discussions and research, Payroll Integrations emerged as a company that provides integrations between payroll companies and benefits providers.

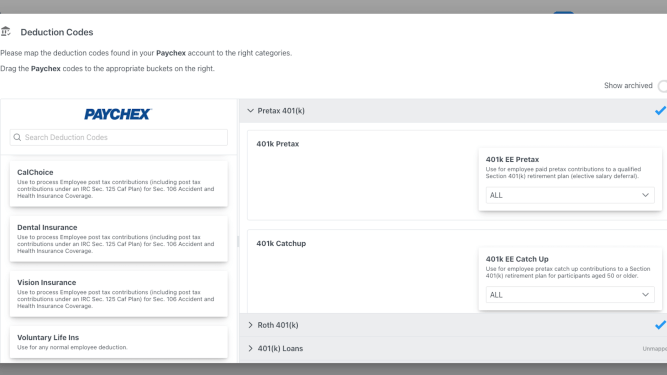

How Payroll Integrations Works

Payroll Integrations’ proprietary technology ingests employee census and payroll data from leading payroll companies in the U.S. This data is then converted into a structured format for employers to connect with retirement, health savings accounts, and other benefit plans. Sabella explained that this process eliminates the manual tracking of payroll and census changes each pay period.

Market Growth and Competitors

The financial wellness benefits market has seen significant growth in recent years, valued at $2 billion and poised to reach $7 billion globally by 2032. With many startups entering the space, Payroll Integrations has carved out a niche for itself by providing a direct two-way connection between payroll and benefits automation as an iPaaS.

Recent Funding and Growth Plans

In a recent announcement, Payroll Integrations secured $20 million in Series A funding from growth equity firm Arthur Ventures. This funding will be used to deploy product development and operations. Sabella expects the company to grow its employee workforce by 50% within the next year.

Upcoming Features and Expansion Plans

Payroll Integrations has several features and expansion plans on the horizon:

- Further penetration into the benefits market: The company aims to strengthen its relationships with payroll providers and expand its offerings.

- Enhanced automation capabilities: Payroll Integrations will continue to develop more efficient ways to manage employee benefits, including automating manual processes.

Building Your First Employee Benefits Package

When building an employee benefits package, consider the following:

- Employee needs: Understand what benefits are most valuable to your employees and tailor your offerings accordingly.

- Cost-effectiveness: Balance the cost of benefits with their value to employees.

- Competitive analysis: Research what other companies in your industry offer and adjust your benefits package accordingly.

Conclusion

As employers seek innovative ways to support their employees’ financial wellness, Payroll Integrations stands out as a leader in payroll integrations with benefits automation as an iPaaS. With its recent funding and growth plans, the company is poised for continued success.