Introduction to Earned Financial

Earned Financial, formerly known as Blvc Development Limited, is a groundbreaking fintech startup that has emerged in recent years with a singular focus on serving high-income healthcare professionals. Known for its innovative approach to wealth management tailored specifically for physicians and other high-earning medical professionals, the company has quickly gained traction in a competitive market. Its mission revolves around providing personalized financial advice, investment strategies, and comprehensive wealth management solutions that cater to the unique needs of its clientele.

The Emergence: A New Name, Same Vision

The transformation from Blvc Development Limited to Earned Financial marks a strategic shift in branding and focus. This renaming underscores the company’s commitment to enhancing its services and delivering superior value to its clients. John Clendening, one of the original founders, stated that "Our goal has always been to empower physicians with the tools they need to manage their financial lives effectively." With this vision in mind, Earned Financial has carved out a niche in the fintech landscape, setting itself apart from traditional wealth management firms.

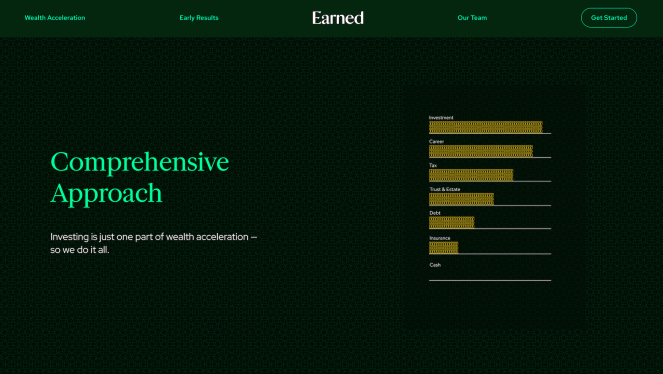

A Proprietary Wealth Management Model

At its core, Earned Financial operates on a proprietary wealth management model that leverages deep insights into the healthcare industry. The company’s approach is centered around three pillars: personalized service, data-driven insights, and strategic financial planning. By integrating real-time data from various sources—ranging from patient performance metrics to market trends—the platform offers actionable insights tailored to each physician’s unique situation.

One of the standout features of Earned Financial’s model is its use of advanced algorithms to predict market trends relevant to physicians’ practices. This predictive capability allows clients to make informed decisions about their investments, risk management strategies, and overall financial planning. The proprietary "Proprietary Wealth Management Engine" (PWME) ensures that each client receives a customized strategy designed around their specific goals and the economic context of their practice.

Extending Beyond Wealth Management

While its primary focus is on wealth management, Earned Financial has also expanded into several related fintech areas, further solidifying its position in the industry. The company offers a range of services, including:

- Practice Management Solutions: Assistance with streamlining operational processes to enhance profitability and efficiency.

- Insurance Solutions: Access to tailored insurance products designed to protect against unexpected medical expenses and other risks.

- Digital Health Tools: Integration of digital health tools that improve patient engagement and streamline healthcare operations.

These services are all offered through a unified platform, ensuring seamless integration and maximizing the utility of the technology for clients.

Expansion into Other High-Earning Professions

Recognizing the potential in its unique model, Earned Financial has expanded its reach beyond the physician vertical. The company is currently exploring opportunities in other high-earning professions, including dentists, lawyers, and engineers. This expansion underscores the versatility of the PWME and its applicability across diverse professional sectors.

Strategic Partnerships and Investments

To accelerate growth, Earned Financial has established strategic partnerships with several prominent firms in the fintech space. These collaborations are designed to enhance the company’s technological capabilities and expand its market reach. Additionally, the company has made significant investments in seed-stage startups that align with its vision of providing innovative financial solutions tailored to high-income professionals.

Macroeconomic Trends Influencing the Investment Management Industry

The global economy presents several macroeconomic trends that are reshaping the investment management landscape. For instance, the increasing number of gig workers is creating a new demographic of investors who demand unique financial solutions. At the same time, the rise of digital platforms offering alternative investment avenues is challenging traditional wealth management firms to innovate and adapt.

In response to these trends, Earned Financial has developed an innovative approach that combines traditional wealth management practices with cutting-edge fintech innovations. This dual strategy allows the company to stay ahead of industry changes while maintaining its competitive edge.

Christine Hall’s Background and Expertise

Christine Hall brings a wealth of experience in the financial sector, having covered enterprise/B2B, e-commerce, and foodtech for TechCrunch. Her expertise has been instrumental in shaping the narrative around Earned Financial as she explores the intersection of fintech innovation and healthcare professional wealth management.

Conclusion: The Future of Physician Wealth Management

As Earned Financial continues to evolve, its focus remains on delivering tailored financial solutions that empower physicians with the tools they need to succeed. By combining a deep understanding of the healthcare industry with innovative technology, the company is poised to become a leader in the fintech space. With strategic partnerships and a clear vision for expansion, Earned Financial is well-positioned to dominate its market and continue its upward trajectory.

In conclusion, Earned Financial represents a paradigm shift in how wealth management services are delivered to high-income professionals. Its proprietary model and commitment to innovation make it a standout player in the fintech industry, with vast potential for future growth and expansion into new markets.